north carolina real estate taxes

North Carolina Tax Tag Together Program. North Carolina residents who have not registered their vehicles or who have not renewed their.

11 Steps North Carolina Home Buying Process

The average homeowner pays 085 of their home value in North Carolina property taxes or 849 for every 1000 in home value.

. Counties in North Carolina collect an average of 078 of a propertys assesed fair market value as property tax per year. Tax amount varies by county. State Assessed Properties - Public Service Companies.

The Property Tax Division of the North Carolina Department of Revenue is the division responsible for this administration. The Tax Rate is the same for real estate as it is for personal property such as. Here we Have Everything you Need.

North Carolina charges an annual personal property tax on cars. Please be sure to enter the first 8-digits of the tax bill number. There is no service fee charge for eChecks.

Use our free North Carolina property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Download a Full Property Report with Tax Assessment Values More. A state in which property taxes make up a smaller percentage of the total revenue collected is generally indicative of low property tax rates.

While each state has its own method for calculating property taxes not all levy them on cars. Job in Winston-Salem - Forsyth County - NC North Carolina - USA 27104. If you are married your spouse must also be 65 years old in order to qualify for the exemption.

April - Property tax delinquencies are advertised in The Sylva Herald. 078 of home value. The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the counties and municipalities.

Office Hours Monday through Friday. Real estate personal property and registered motor vehicle tax bills can be paid 24 hours a day 7 days a week by credit card or debit card. You will still be responsible for paying property taxes on any other real estate you own.

The Tax Foundation ranks North Carolina as 30 out of the 50 states in property taxes paid as a percentage of owner-occupied housing value. Vehicles boats and business equipment. In other words it is less expensive than 29 states but more expensive than.

The program combines your annual vehicle inspection registration renewal and vehicle property tax are due the same month. At this time we do not accept business tax payments by telephone. We accept American Express Discover MasterCard and Visa.

Please be sure to enter the entire 24-digit tax bill number. Let SearchAndShopping Find Your Results Today. Its Fast Easy.

A convenience fee of 235 or a minimum of 195 will be charged for all credit card and debit card payments. The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000. Our property records tool can return a variety of information about your property that affect your property tax.

Tax returns and payment are due each month on or before the twentieth 20 th day of the month following the month in which the tax accruesThe tax lien or assessment date each year is January 1 stTaxes are due and payable September 1 st. On average homes in North Carolina are worth 195670. In North Carolina the average rate is 077.

Individuals can self-register using the Havent Registered. Ad View County Assessor Records Online to Find the Property Taxes on Any Address. As part of NCDMVs Tag Tax Together program the vehicle owner pays the property tax at the same time as the vehicles registration renewal fee.

Welcome to our new system. Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and taxation of property by taxing units throughout the State. 2020 taxes are payable without interest through January 5 2021.

336-203-7795 credit debit cards only 3. North Carolina property tax law requires counties to assess the value of motor vehicles registered with the NC. PO Box 71072 Charlotte NC 28272-1072 No CASH Please The Guilford County Tax Department uses a service called Payit that allows you to pay tax bills online by phone or in person.

In North Carolina you stop paying property taxes when you reach the age of 65. 2021 Orange County property tax bills were due and should have been paid by January 5 2022 to avoid delinquency. Mail your check or money order to.

The state requires the counties to assess and collect property taxes on cars registered with the Department of Motor Vehicles or DMV. The exemption applies to your primary residence only. List appraise assess and collect all real and personal property for ad valorem tax purposes in compliance with NC.

Pay at the Tax Collectors office on the first floor of the Union County Government Center Monday through Friday between 800 am. The average effective property tax rate in the nation is 107 of the assessed value. This site is designed specifically for the use of the North Carolina Association of Assessing Officers NCAAO and the North Carolina Tax Collectors Association NCTCA organizations their jurisdictions and associates.

How often are property taxes paid in North Carolina. Payit collects processing andor transaction fees to deliver quality services. North Carolina has one of the lowest median property.

ECU baseball beats Coastal Carolina 13-4 advances to. 33 minutes agoProperty taxes going up as Wake County approves 17 billion budget. Interest in the amount of 2 was added to the amount past due on January 6 2022 and additional interest in the amount of 075 is added at the first of each month that the taxes remain unpaid per North Carolina General Statutes.

Division of Motor Vehicles. Welcome NC Property Tax Professionals. Forsyth County North Carolina.

Tag and Tax Together Program. North Carolina baseball downs VCU 7-3 to win Chapel Hill Regional.

The Ultimate Guide To North Carolina Property Taxes

2022 What To Expect In North Carolina Real Estate

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

North Carolina State Taxes 2022 Tax Season Forbes Advisor

Tax Administration Duplin County Nc Duplin County Nc

How To Calculate Closing Costs On A Home Real Estate

Farmhouse Nc Real Estate 445 Homes For Sale Zillow

North Carolina Sales Tax Small Business Guide Truic

North Carolina Real Estate Transfer Taxes An In Depth Guide

What 700 000 Buys You In Texas Oregon And North Carolina The New York Times

Is Wholesaling Real Estate Legal In North Carolina Ultimate Guide

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

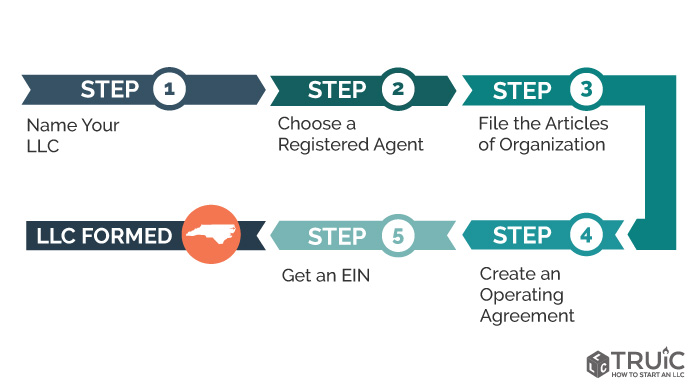

How To Set Up A Real Estate Llc In North Carolina Truic

Tax Administration Duplin County Nc Duplin County Nc

North Carolina Estate Tax Everything You Need To Know Smartasset

Real Estate Property Tax Data Charleston County Economic Development